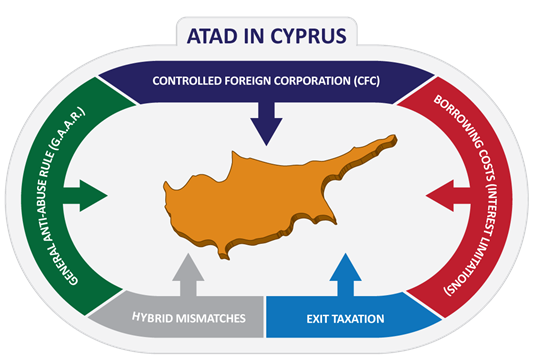

Cyprus is currently in the process of implementing the EU Anti-Tax-Avoidance Directive (ATAD), which basically aims at preventing multinational companies sheltering their profits in low or no tax jurisdictions.

ATAD is the European Union’s answer to the OECD Base Erosion and Profit Shifting action plan, commonly referred to as BEPS. It aspires to ensure that taxes are paid where the value is created. To achieve these goals, ATAD sets out identical rules for all the players of the game and multinational companies in particular. EU countries, including Cyprus, are obliged to implement ATAD at the required dates being 1 January 2019 and 1 January 2020.

Specifically, it is expected that the relevant provisions relating to Interest Limitations, Controlled Foreign Corporation (CFC) rules, and General Anti-Abuse Rules (GAAR) will be included in the local legislation and will be retroactively effective as from 1 January 2019.

For Exit Tax rules as well as for Hybrid Mismatches, the relevant provisions are expected to be voted within 2019 with an effective date of 1 January 2020.

This tax alert aims at proving an easy to follow, yet compressive analysis on these proposed provisions and their expected impact on the Cyprus Tax Legislation.

- CFC Rules

Controlled Foreign Corporation (CFC) is a fairly new concept in Cyprus. This concept aims at allocating income to a Cyprus tax resident company when its subsidiary or permanent establishment is located in a low or no tax jurisdiction, even if this income is not actually distributed as dividend (subject to conditions).

The definition of a CFC is expected to be the same as in ATAD, namely an overseas permanent establishment or company directly or indirectly controlled by a Cyprus tax resident company, the corporate profit tax burden of which is less than half of what it would be under the Cyprus tax system i.e. 6.25%.

The provisions to be implemented in the Cyprus tax legislation are expected to adopt the approach set out in Article 7 of the ATAD under which specified categories of income including interest, royalties and dividends receivable by the CFC are to be included as current income in the tax base of the Cyprus parent and taxed in accordance with Cyprus rules, unless the CFC is resident in an EU or European Economic Area country and engages in substantive economic activities.

- Impact on subsidiaries

In light of the relatively low headline tax rate on trading profits in Cyprus, it may be the case that many Cyprus subsidiaries of EU Corporations will be treated as CFCs in other Member States under the ATAD rules. Multinational groups with Cyprus subsidiaries that are held directly or indirectly by companies located in other EU Member States may, therefore, have to consider whether the income of their Cypriot subsidiaries could be subject to the CFC charge as applied by the tax authorities of other Member States. The application of the CFC rules to Cyprus subsidiaries will be influenced by the activities of the relevant entity.

- Impact on holding companies

For the first time, Cyprus holding companies will have to consider whether any of their subsidiaries are CFCs. The appropriate corporation tax rate applicable to determine whether a subsidiary is a CFC are not, is also unclear. For example, will the authorities compare the Cyprus corporation tax rate of 12,5% with the actually tax paid by the subsidiary or the corporation tax rate of that specific country ignoring the actual tax paid?

Once implementing the relevant provisions, it may be necessary to review existing Cyprus holding structures in light of the new CFC rules under the ATAD.

- Borrowing Costs

The most significant provision of the ATAD in practice is likely to be the introduction of fixed-ratio interest limitation rules.

The new provisions are expected to deny a deduction in respect of net interest expense (being gross interest expense less interest income) that exceeds 30% of the taxpayer’s EBITDA (profit adjusted for tax purposes before interest, tax, depreciation and amortization) or €3 million, whichever is higher.

The limit is expected to be applied at the company level unless the company is a member of a group for Cyprus tax purposes, in which case the rule will be applied at the level of the Cyprus group.

The rule will not apply to wholly independent companies (i.e. a taxpayer that is not part of a group for financial reporting purposes and has no investments in associated companies (minimum 25% participation)) or financial institutions. Certain public infrastructure projects and their associated income are expected to be outside the applicability of the specific provisions, together with financial arrangements entered into before 17 June 2016 and not subsequently amended.

The draft law is expected to include a group equity carve-out provision that permits taxpayers to deduct net interest exceeding the 30% threshold if the taxpayer’s equity to total assets ratio is higher than (or at least no more than 2% lower than) the equity to total assets ratio of the worldwide group.

The interest costs to be restricted may be carried forward for up to five years.

To ascertain the potential impact of the interest limitation rules, domestic groups and multinational groups with Cyprus operations should review their current financing structures in respect of Cyprus and EU entities, identifying entities that might exceed the 30% limit. Groups should carefully consider the impact that the interest limitation rule will have on new loans (i.e. loans agreed on or after 17 June 2016) agreed by Cyprus companies. However, any responsive action to the interest limitation rules should be postponed until taxpayers have reviewed the relevant final Cypriot implementing legislation.

In general, Cyprus companies in multinational groups tend not to be heavily leveraged in light of the restrictive nature of Cyprus tax provisions on interest when compared with other jurisdictions. Furthermore, many Cyprus financing companies may not be affected by the interest limitation rules on the basis that the interest receipts of such companies should exceed their interest expenses.

- Exit Taxation

The draft provisions regarding exit taxation provide for taxpayers to be liable to tax being equal to the difference between the market value and the value for tax purposes of assets to be transferred outside the net of the Cyprus tax legislation while remaining under the same ownership.

Taxpayers may settle the exit taxes with instalments over five years.

The proposed effective date is 1 January 2020, as in the ATAD.

- General Anti-Abuse Rule (GAAR)

The new provisions will allow the Commissioner of Taxation to disregard artificial arrangements whose main purposes include obtaining a tax advantage that defeats the object or purpose of the tax laws.

The Cyprus tax legislation and more specifically the Assessment and Collection of Taxes Law already contains a GAAR and therefore the amending provisions are not expected to have significant implications on Cypriot taxpayers.

- Hybrid Mismatches

The draft proposal includes rules on hybrid mismatches which supplement similar provisions introduced in 2015 to implement the amended EU Parent-Subsidiary Directive.

Hybrid mismatches exploit differences between tax systems to achieve double non-taxation i.e. double deduction, deduction without inclusion and non-taxation without inclusion. For example, a payment in one Member State can be considered as interest (which will be tax deductible for tax purposes) and in the other Member State as dividend (which is will be non-taxable).

The anti-hybrid rules are expected to apply to cases between associated taxpayers in two or more Member States or structured arrangements between parties in Member States that, arising from differences in the legal characterisation of a financial instrument or entity, result in:

- a double deduction (i.e. a deduction for the same payment, expense or loss in two different Member States) or

- a deduction without inclusion (i.e. a payment that is deductible for tax purposes in the payer’s jurisdiction but is not included in the taxable income of the receiving taxpayer).

If the mismatch results in a double deduction, the relevant payment will be deductible in the source Member State only. If the mismatch results in a deduction without inclusion, the deduction should be denied in the Member State of the payer.

As in the Directives, the provisions regarding mismatches of hybrid instruments and tax residence are due to take effect from 1 January 2020, and those relating to reverse hybrid mismatches will take effect on 1 January 2022.

The Cyprus tax system is relatively straightforward, and it is unusual to see Cypriot instruments or entities that have a different legal characterisation in another EU Member State. Therefore, the amending provisions are not expected to have significant implications on Cypriot taxpayers.

As can be derived from the above, the transposition of the ATAD’s provisions within the Cyprus tax legislation will have a significant and direct impact on the tax infrastructure in Cyprus. In addition to providing for the introduction of entirely new concepts, certain elements of the Cyprus tax legislation may need to be realigned to complement the implementation of the ATAD measures.

Therefore, it is recommended that clients shall assess the practical impact of the implementation of the ATAD on their Cyprus structures and a detailed and constructive review of the impact of the implementation of the new provisions is undertaken in order to assess any exposure.