-

Posted in News, News for Cyprus, News for Greece

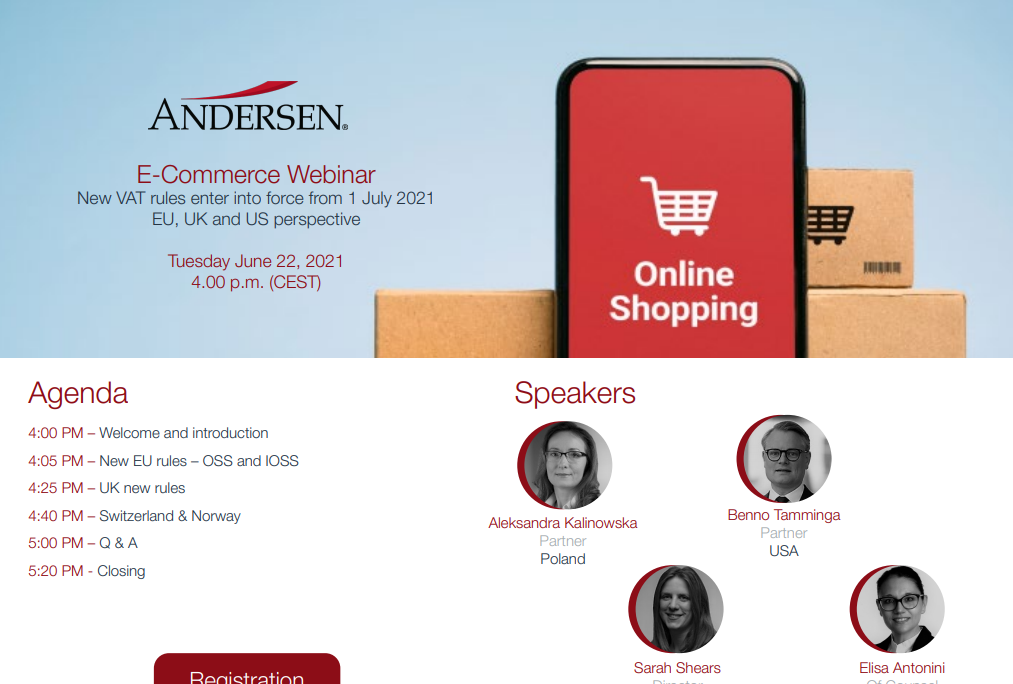

E-Commerce Webinar: 22 JUNE, 4 PM CET

VAT & Customs Service Line of Andersen will organize a webinar on 22nd of June. Read the webinar agenda and the key speakers and click to register.

-

Posted in News, News for Greece

GDPR Flash news: Greek DPA imposes fine for non-compliance with data subject’s rights

The article refers to the recent fine imposed by the Greek DPA on well-established job-seeking platform for non-compliance with a data subject’s right to erasure. The audit performed revealed…

-

Posted in News, News for Greece

Banking, Finance & Capital Markets: Corporate Governance

The Hellenic Capital Market Commission (HCMC) issues guidelines and recommendations to Listed Companies towards compliance with the new Law 4706/2020 on Corporate Governance.

-

Posted in News, News for Cyprus

Cyprus Tax News: Tax treatment of effects of adopting IFRS 9, 15, and 16 clarified

On 17 May 2021, the Tax Department issued a Guideline providing clarifications with respect to the tax treatment of the impact on the financial statements from the application of IFRS 9, IFRS 15 and IFRS 16 for both Income Tax (IT) purposes…

-

Posted in News, News for Greece

Episode #7 Related Parties Transactions: An Overview

On Episode7 of the Andersen Legal Podcast, Dimitra Gkanatsiou, Head of Corporate & Commercial and Andriani Tzamarou, Associate are providing an overview of the “Related Parties Transactions”.

-

Posted in News, News for Greece

Banking, Finance & Capital Markets: An Introduction

The Banking, Finance and Capital Markets practice is under a process of a radical reform and our promise is to actively support our clients’ sustainable growth on the field

-

Posted in News, News for Cyprus, News for Greece

EMPLOYMENT WEBINAR | Covid-related restrictions for employment termination across Europe

The European Employment group hosted a Webinar to cover the Covid-related restrictions for employment terminations. Below you may find a summary of the event insights.

-

Posted in News, News for Cyprus

Cyprus Tax News: Relief from interest and penalties on overdue taxes for tax years 2016 – 2019

We would like to inform you that an amending law was published in the Government Gazette which extends the provisions of the Law Regulating the Settlement of Overdue Taxes (the Law), offering part relief…

-

Posted in News, News for Greece

Andersen Legal: Exclusive contributor to The Legal 500 Data Protection and Cyber Security Comparative Guide

Andersen Legal is the Exclusive Contributor to “The Legal 500” Data Protection & Cyber Security Comparative Guide 2021 for Greece. The TMT team contributed for 3rd consecutive year.

-

Posted in News, News for Cyprus

Cyprus offers up to 30% tonnage tax cut with new Green Incentive Programme

The Deputy Ministry of Shipping of Cyprus recently announced a new ‘Green Incentive Programme’ to reimburse vessels that show effective emissions reductions. From fiscal year 2021, annual tonnage tax